Fraud is a silent killer for customer programs like referral and loyalty initiatives, quietly eating away at your profits and customer trust. Whether it's customers gaming the system, employees exploiting inside access, or hackers using sophisticated techniques, the threat is real and only getting smarter.

While a single instance of fraud might seem insignificant, the cumulative effect can be devastating. Unchecked fraud doesn't just eat into profits - it can force businesses to shut down entire programs. This damage extends further when it's time to relaunch, with companies facing hefty marketing costs to rebuild awareness and restore their reputation.

The Wells Fargo case is a stark reminder of the dangers of unchecked fraud - fake accounts, huge fines, and severe reputational damage. It shows just how quickly things can spiral out of control when fraud prevention measures are lax.

Here’s the thing, combating fraud isn't just about using the strictest measures. Go too hard, you might end up with a program that turns customers away, hurting your business in the process. So, how do you find the sweet spot between cracking down on fraud and keeping your customer experience smooth?

💥 Unmasking fraud

Let’s clarify what we are up against. Fraud can take many forms, it’s not just one type of threat and it is found across consumer programs—coupon-related fraud, loyalty programs, referral programs, affiliate programs, and more.

Some key types of fraud:

Customer Fraud: Creating fake accounts or misusing offer codes.

Employee Fraud: Employees exploiting their inside access for personal gain.

Retailer Fraud: Manipulating offer codes or discounts for profit.

Hacker Fraud: Hackers manipulating systems with advanced tech.

Each fraud type has its own methods and motivations, but one thing in common: taking advantage of your customer program.

Take a closer look at what might tempt rule-bending. Sure, cash rewards and large discounts can sometimes be enticing, but it’s not always about financial gain. Employees and partners could be feeling pressure from high pay-for-performance targets, or long-time customers might be frustrated seeing new customers get better deals. It’s these deeper motivations, not just the program perks, that can push people to cross the line. Understanding these drivers will help you address fraud more effectively.

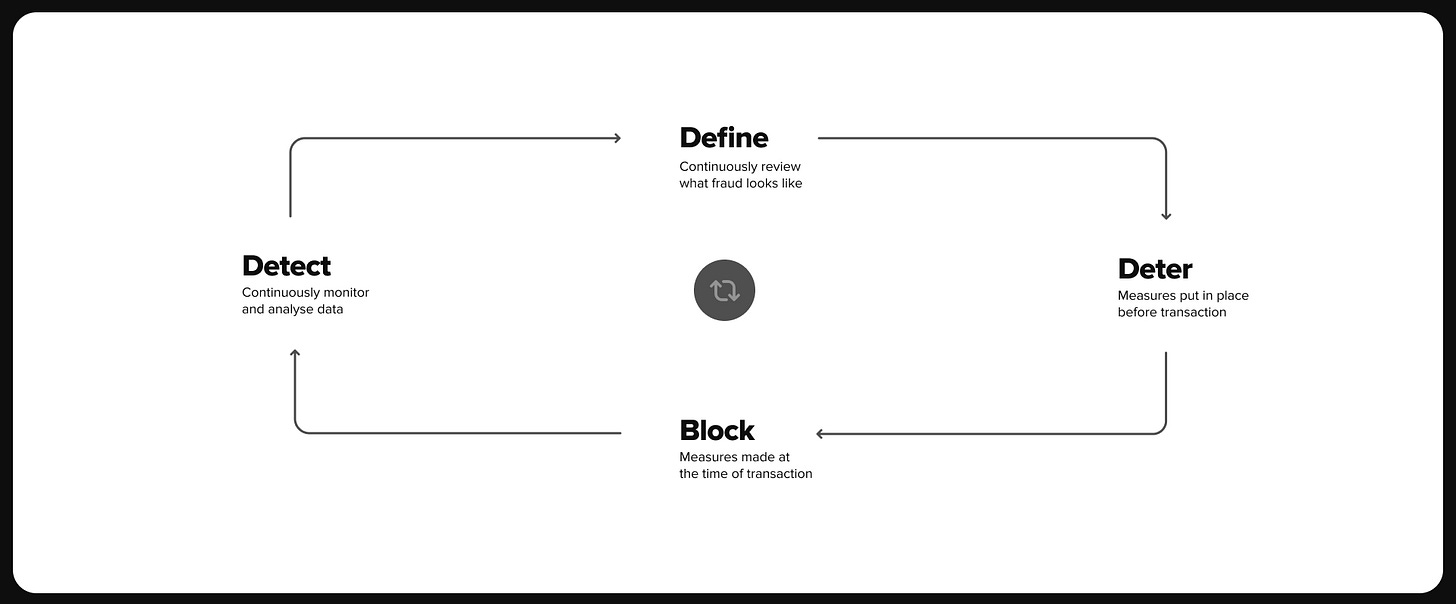

Define your fraud strategy by outlining what constitutes fraud and what you will tolerate, and establish a policy for handling fraudulent activities.

Deter fraud with simple, clear communication on program rules and by making adjustments to the rewards structure, adding some limits to minimise the risk of abuse.

Block suspicious activity using real-time software and use ID verification to stop multiple account creations in their tracks.

Detect potentially fraudulent behaviours by continuously monitoring and analysing data.

Fraud management is a constant process of adapting to emerging data. As new fraud is spotted, the framework adapts. Redefine what fraud looks like, adjust your tolerance levels, and fine-tune your deterrence and blocking tactics. And if the data shows it’s hurting your real customers, it’s definitely time to rethink your approach.

1. Define 🔍

Sometimes it’s okay to let fraud slide. Think of a resourceful shopper who finds a referral discount online before purchasing - not exactly a genuine referral. Is it worth sweating over a little bit of fraud if it means keeping your customers happy and coming back for more? Maybe not.

Remember how Uber and Airbnb took off. They knew easy-to-share referral codes could be misused, but the large growth they achieved far outweighed those risks. Sometimes, you tolerate minor rule-breaking if it fosters satisfaction, growth, and retention - especially if it doesn't hurt your bottom line.

Start by asking, 'What do we consider fraud to our business?’ with these realities in mind from the outset. Support this process by digging into your data to pinpoint specific use cases within your business context. The sweet spot is where security meets a smooth, no-fuss customer experience, which might just mean letting the small stuff go.

At this stage, it’s crucial to define your fraud policy. Not all fraud is the same, and your responses shouldn’t be either. Based on the level of risk and who’s behind the fraud - whether it’s employees exploiting their inside access or customers bending the rules - outline the appropriate consequences for each type of fraud.

2. Deter ⚠️

Education is a no-brainer; make sure all players, from customers to partners, know the rules of fair use. Tailor your response to different stakeholders - hands-on communication with retailers or partners can flag them early, ensuring they’re aware of the spotlight.

Tweaking your rewards structure can make a huge difference in minimising fraud. Consider introducing limits such as how many times a referral code can be used within a set period or how many discounts one customer can earn. These are obstacles that make it harder to game the system without outright shutting anyone out. Keep in mind that if you go too far in restricting rewards, you risk driving customers away.

3. Block ❌

Tighter identity checks and multi-layered authentication can put the brakes on fraud by preventing multiple account creation. If your business faces high fraud risk, it's worth going the extra mile. Consider using third-party software like device fingerprinting. These tools can spot suspicious activities and flag potential fraudsters before they cause trouble.

The tricky part is if you clamp down too hard on fraud, you risk frustrating your customers. Nobody loves clicking through countless verification steps just to access a service. The challenge is to protect your program without making your customers feel like they’re jumping through hoops.

4. Detect 👀

To detect fraud effectively, continuous monitoring and real-time analytics are key. By analysing transaction patterns and flagging unusual behaviour, you can catch fraudulent activities before they escalate. As new fraud trends emerge, continuous data analysis helps refine your fraud strategy. It also keeps you in check, showing if your fraud measures are too strict and causing a drop in engagement with your program.

In the end, navigating fraud isn’t about rigid control. It’s about staying sharp, adaptable, and focused on what truly matters—your customers. To perfect the balance between customer experience and fraud management, test your strategy before scaling.

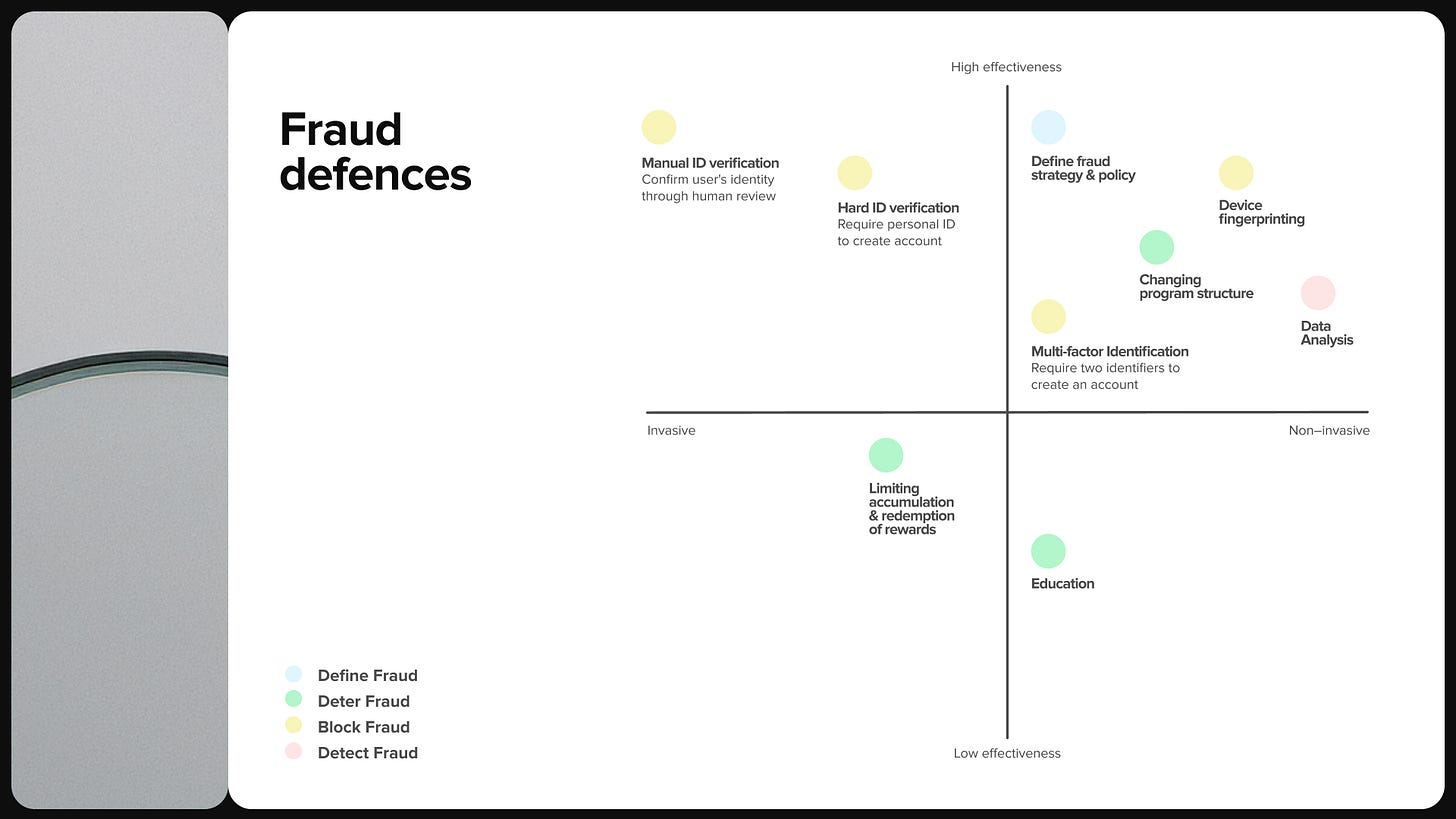

ℹ️ Refer to the image below to evaluate your fraud defences. It highlights how the solutions outlined above compare in terms of preventing fraud while maintaining customer satisfaction. Some approaches are highly effective but may feel invasive, while others are more lenient but less thorough. Understanding where each solution stands enables you to strike the right balance between security and a seamless customer experience.